portland oregon sales tax 2021

This is the total of state county and city sales tax rates. Try our FREE income tax calculator.

8 Things To Know About Oregon S Tax System Oregon Center For Public Policy

Wayfair Inc affect Oregon.

. Portland Oregons Sales Tax Rate is 0 IRSgov 2021 2. Roseburg OR Sales Tax Rate. TAX DAY NOW MAY 17th - There are -442 days left until taxes are due.

The average cumulative sales tax rate in Portland Oregon is 0. The Oregon sales tax rate is 0 as of 2022 and no local sales tax is collected in addition to the OR state tax. Online Services We offer a variety of online services including business registration uploading tax pages filing a returnextension exemptions and payments.

To 100000 based on Oregon sales approx. The latest sales tax rate for Portland OR. Combined with the state sales tax the highest sales tax rate in Oregon is NA in the cities of Portland Portland Salem Beaverton and Eugene and 102 other cities.

TAX DAY NOW MAY 17th - There are -441 days left until taxes are due. Or 2 Minimum tax ranging from 150 to 100000 based on Oregon sales approx. The five states with the highest average combined state and local sales tax rates are Louisiana 955 percent Tennessee 9547 percent Arkansas 948 percent Washington 929 percent and Alabama.

The Portland Oregon sales tax is NA the same as the Oregon state sales tax. The latest sales tax rates for cities in Oregon OR state. For tax years beginning on or after January 1 2019 the Clean Energy Surcharge CES is a 1 surcharge on Retail Sales within the City of Portland imposed on Large Retailers.

Did South Dakota v. Valley region of the Pacific Northwest at the confluence of the Willamette and Columbia rivers in Northwestern Oregon. 1350 per proof-gallon or 214 per 750ml 80-proof bottle.

100 Working Portland sales tax calculator Updated 2021 and providing the best and accurate results you can get non other than on 360 taxes. Start filing your tax return now. Within Portland there are around 58 zip codes with the most populous zip code being 97229.

2020 rates included for use while preparing your income tax deduction. The Portland sales tax rate is. Filing Requirements All businesses that report total gross income of 1 billion or more and Portland gross income of 500000 or more on their Combined Business Tax.

View City Sales Tax Rates. Most states have a sales tax ranging between 4 and 7. Income Tax Calculator.

Our free online Oregon sales tax calculator calculates exact sales tax by state county city or ZIP code. Last updated August 2022. TAX DAY NOW MAY 17th - There are -443 days left until taxes are due.

2020 rates included for use while preparing your income tax deduction. While many other states allow counties and other localities to. The Oregon sales tax rate is currently.

Corporations exempt from the Oregon Corporation Excise Tax under ORS 317080 generally not-for-profit corporations unless subject to tax on unrelated business income. 1 66 on taxable income of 1 million or less 76 on taxable income greater than 1 million. The sales tax in Portland Oregon is currently 75.

What state has the highest sales tax. Federal excise tax rates on beer wine and liquor are as follows. The minimum combined 2022 sales tax rate for Portland Oregon is.

Portland OR Sales Tax Rate. Start filing your tax return now. The Red Seal Two Dollar Bill.

The vehicle use tax applies to Oregon residents and businesses that purchase vehicles outside of Oregon. As of 2019 Portland had an estimated population of 654741 making it the 26th. Information about Portland Business License Tax Multnomah County Business Income Tax and Metro Supportive Housing Services.

Oregon is sales tax free and to boot has a lower cost of living compared to the national average. Redmond OR Sales Tax Rate. This rate includes any state county city and local sales taxes.

The 2018 United States Supreme Court decision in South Dakota v. This rate is made up of a 65 state sales tax and a 10 local sales tax. 107 - 340 per gallon or 021 - 067 per 750ml bottle depending on alcohol content.

City of Portland Revenue Bureau. The local sales tax rate in Portland Oregon is 0 as of January 2022. The personal income tax rate is 15 on Multnomah County taxable income over 125000 for individuals or 200000 for joint filers and an additional 15 on Multnomah County taxable income over 250000 for individuals or 400000 for.

01 of sales Washington Business Occupation BO Tax Gross receipts tax with various. Sales tax region name. Business Registration Everyone doing business in Portland or Multnomah County is required to register.

OR Rates Calculator Table. Rates include state county and city taxes. The County sales tax rate is.

View County Sales Tax Rates. Start filing your tax return now. The Green Token Newbie In Cryptocurrency World.

The tax is adjusted depending on the. No payment is due with the registration form. Historical Sales Tax Rates for Portland.

01 of sales Greater of. This includes the rates on the state county city and special levels. Portland Tourism Improvement District Sp.

Portland has parts of it located within Clackamas County Multnomah County and Washington County. A proof gallon is a gallon of liquid that is 100 proof or 50 alcohol.

7933 Sw 40th Ave Portland Or 2 Baths In 2021 Southwest Portland Real Estate Sales Multnomah County

Siuslaw National Forest Tillicum Beach Campground

Oregon Tax Rates Rankings Oregon State Taxes Tax Foundation

Oregon Economic And Revenue Forecast December 2019 Oregon Office Of Economic Analysis Economic Analysis Oregon Forecast

8 Things To Know About Oregon S Tax System Oregon Center For Public Policy

Home Staging Services Copeland Co Interiors Portland Oregon

Oregon State 2022 Taxes Forbes Advisor

Daily Schedule High Desert Museum Daily Schedule Desert Ecosystem Deserts

Current Covid 19 Related Tax Guidance For Oregon Washington And California Kbf Cpas

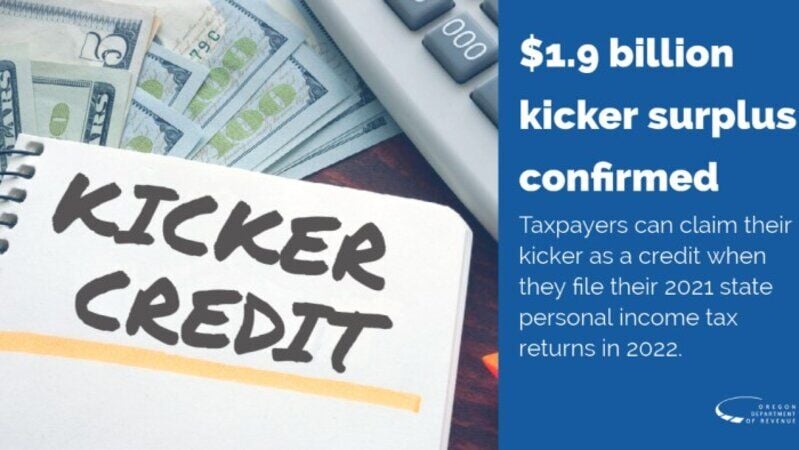

Oregon Taxpayers Will Receive Kicker Rebate On 2021 Tax Returns Thanks To 1 9 Billion Surplus Local Kdrv Com

Lotiekids Blueberry Print Kids Peach Sweatpants In 2021 Cotton Sweatpants Peach Kids Outfits

Pin By Deb Zanghi On Books Monticello Best Sellers American

8 Things To Know About Oregon S Tax System Oregon Center For Public Policy

New Sales Tax Rules For Oregon Residents Overturf Volkswagen

Oregon Tax Rates Rankings Oregon State Taxes Tax Foundation

Fusion Wall Beds Library Queen Size El Qn Multiple Finishes White 4 Shelves No Side Shelves

Pin On For The Love Of The Us West Coast Oregon Travel Portland Travel Travel Usa